GCash, the leading mobile wallet service in the Philippines, has expanded its reach by launching GCash Overseas. The new service allows Filipinos living and working abroad to use GCash and enjoy its features even while they are away from home.

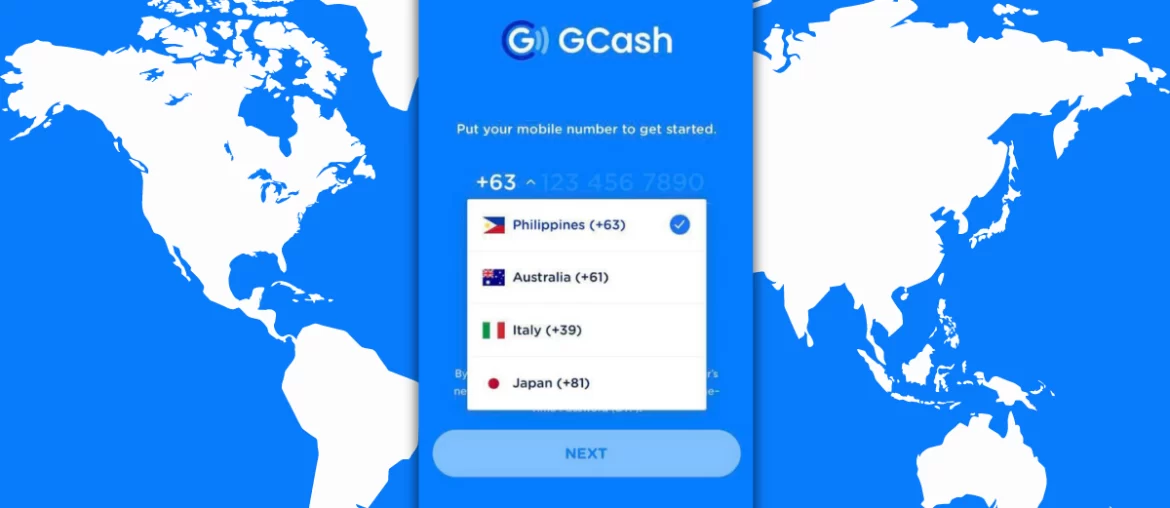

The service was first made available to Filipinos in Japan, Australia, and Italy, with plans to expand to more countries in the future. Through GCash Overseas, users can send and receive money to and from any GCash account, pay bills, purchase load credits, and other services.

To sign up for GCash Overseas, users need to have a Philippine passport or any valid Philippine ID for verification. Once their account is verified, they can use GCash Overseas to transfer money to their loved ones back home or make online purchases using their GCash account.

GCash CEO and President, Martha Sazon, stated that the launch of GCash Overseas is part of their mission to make financial services accessible to every Filipino, even those who are living outside the country. She added that GCash Overseas will help bridge the gap between Filipinos abroad and their loved ones back home.

The launch of GCash Overseas comes at a time when the COVID-19 pandemic has forced many Filipinos to work and live overseas, away from their families. With GCash Overseas, they can now easily send money to their loved ones back home, pay bills, and make purchases using their GCash account.

GCash Overseas is still in its BETA phase, and services will only be available to the first 1,000 Filipinos who sign up. However, GCash plans to expand the service to more countries soon, enabling more Filipinos to benefit from its features.

In conclusion, the launch of GCash Overseas is a welcome development for Filipinos living and working abroad. The service will provide them with an easy and convenient way to manage their finances, send money to their loved ones back home, and make online purchases using their GCash account. With GCash Overseas, Filipinos can stay connected with their families and loved ones, no matter where they are in the world.

Comments are closed.